CBIC has issued the most awaited clarification vide circular number 45/19/2018 GST dtd. 30.05.2018. Highlights of the said circular are given below:

- The said restriction is not applicable to an exporter who has procured goods from suppliers who have not availed the benefits of the specified notifications for making their outward supplies. Further, the said restriction is also not applicable to an exporter who has procured goods from suppliers who have, in turn, received goods from registered persons availing the benefits of these notifications since the exporter did not directly procure these goods without payment of tax or at reduced rate of tax. Restriction under sub-rule (10) of rule 96 of the CGST Rules is only applicable to those exporters who are directly receiving goods from those suppliers who are availing the benefit under notification No. 48/2017-Central Tax dated the 18th October, 2017, notification No. 40/2017-Central Tax (Rate) dated the 23rd October, 2017, or notification No. 41/2017-Integrated Tax (Rate) dated the 23rd October, 2017 or notification No. 78/2017 Customs dated the 13th October, 2017 or notification No. 79/2017-Customs dated the 13th October, 2017. Further, there might be a scenario where a manufacturer might have imported capital goods by availing the benefit of Notification No. 78/2017-Customs dated 13.10.2017 or 79/2017-Customs dated 13.10.2017. Thereafter, goods manufactured from such capital goods may be supplied to an exporter. It is hereby clarified that this restriction does not apply to such inward supplies of an exporter.

- Thus, the restriction under sub-rule (10) of rule 96 of the CGST Rules is only applicable to those exporters who are directly receiving goods from those suppliers who are availing the benefit under notification No. 48/2017-Central Tax dated the 18th October, 2017, notification No. 40/2017-Central Tax (Rate) dated the 23rd October, 2017, or notification No. 41/2017-Integrated Tax (Rate) dated the 23rd October, 2017 or notification No. 78/2017Customs dated the 13th October, 2017 or notification No. 79/2017-Customs dated the 13th October, 2017.

- Further, there might be a scenario where a manufacturer might have imported capital goods by availing the benefit of Notification No. 78/2017-Customs dated 13.10.2017 or 79/2017-Customs dated 13.10.2017. Thereafter, goods manufactured from such capital goods may be supplied to an exporter. It is hereby clarified that this restriction does not apply to such inward supplies of an exporter.

- Though, the said clarification does not resolve the issues raised above except for purchase of capital goods by the supplier against notification no. 78/2017 Cus or 79/2017 Cus both dtd 13.10.2017 and goods are supplied to the exporters. The restriction will not be applicable to the exporters.

- Refund of un-utilised ITC of compensation cess availed in cases where final product is not subject to levy of compensation cess on account of zero rated supply.

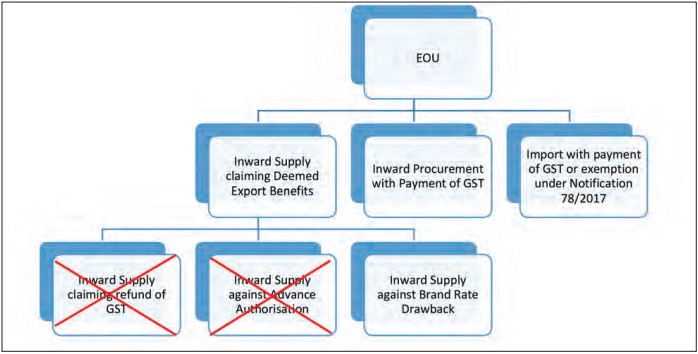

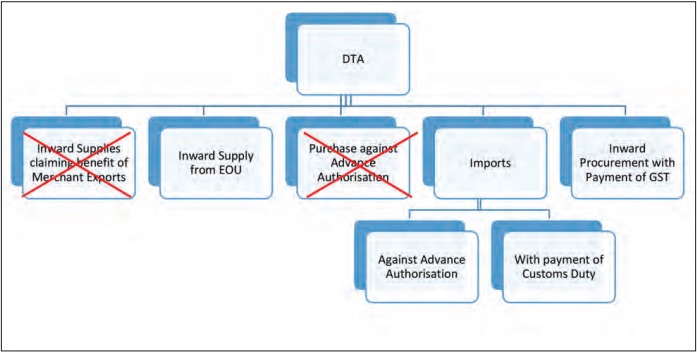

- It is further clarified that LUT should not be insisted for zero rated supply of exempted on non-GST goods i.e. non-taxable goods If EOU wish to claim the refund of I GST paid on exports, then EOU will have to ensure that there is no inward supply claiming refund of GST or inward supply against advance authorization otherwise EOU will have to apply refund under Rule 89 only. Below chart provides more clarity. Similarly, domestic unit wish to claim the refund of IGST paid on exports, then DTA will have to ensure that there is no inward supply claiming benefit of merchant exports and Inward supplies against Advance Authorization otherwise DTA will have to apply refund under Rule 89 only. Below chart provides more clarity Clarification is needed whether it is for individual supplies or exporters have been put to the exporters without any time limit for claiming refund under Rule 96 of CGST Rules 2017 Recommended

GST QuizGST RulesGST SearchGST RegistrationGST RatesGST FormsHSN Code ListGST Login