Note on New GST Rate for Real Estate

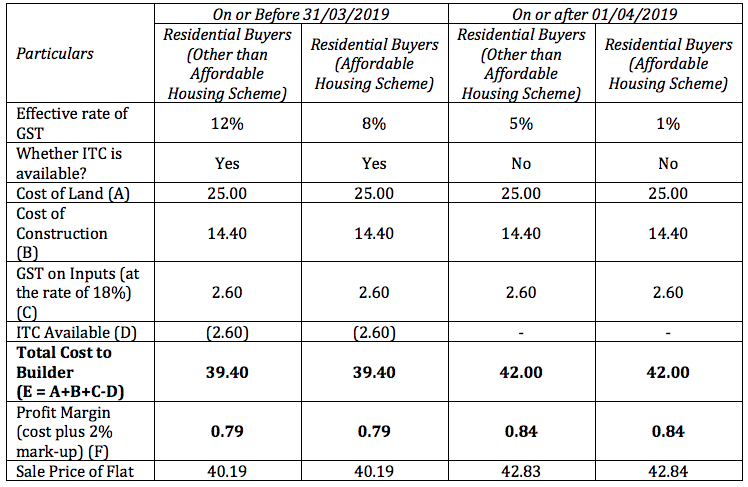

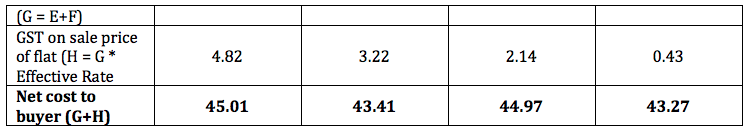

The new tax rates shall be available, subject to the condition that ITC shall not be available and 80 % of inputs and input services should be purchased from registered persons. Any shortfall in purchases from the registered persons shall lead the builder to pay the applicable higher GST on Reverse Charge Mechanism basis. Details have also been summarized in the table below: Developers of the ongoing residential projects have also been given an onetime option to choose between the old tax rates with ITC and the new rates without ITC for under-construction residential projects so as to resolve any issues related to the input tax credit. Comparing the prices of a residential house property before and after April 1, 2019. Though the rate of GST has been reduced substantially, but the net benefit to the customer is insignificant. The modality of new tax rate: The modality for transition: Note-1: Ongoing projects where the construction and booking both have started before 1st April, 2019 and have opted for new tax rates shall transition the input tax credit (ITC) as per the prescribed method. ITC for the entire project shall be arrived at by extrapolating the ITC taken on basis of the percentage of completion as on 1st April, 2019. Eligibility of ITC shall be determined on basis of the percentage of booking of flats and invoicing done. Therefore, on pro-rata basis the ITC credit shall be allowed, i.e., credit in proportion to booking of the flat and invoicing done for the booked flat. New Projects – All houses which meet the definition of affordable houses having an area of not more than 60 sqm and 90 sqm in non-metros and metros, respectively, and the value of the house should also not be more than Rs. 45 lakhs. Ongoing Projects – Affordable houses being constructed under the existing Central and State housing schemes where the existing concessional rate of 8% GST is applicable New Projects – All houses other than the affordable houses in the new projects. Ongoing Projects – All houses other than the affordable houses in ongoing projects whether booked prior to or after 1st April, 2019. In case of the house is booked prior to 1st April, 2019, new rates shall be applicable only on instalments payable on or after 1st April, 2019. (Note-1 and 2) Note-2: New rate of 5% shall also be applicable on commercial apartments such as shops, offices, etc, which are constructed in the resident real estate projects provided the carpet area of commercial apartments is not more than 15% of total carpet area of all the apartments.

Commercial Projects

On Commercial projects, whether ongoing or new, GST rates have not been changed Rate – GST rate shall remain at 12% ITC – Input tax credit shall be available Applicability – All new or ongoing projects which consist of 100% commercial apartments such as shops, offices, etc

Mixed Use Projects

Mixed use projects are those projects which consist of residential houses as well as commercial properties and the carpet area of the commercial projects is more than 15% of the total carpet area of all the apartments. Rate – GST rate shall remain at 12% for the commercial apartments and for housing sector GST rates as defined in the relevant sections mentioned above. ITC – Input tax credit shall be available only for commercial segment. For a mixed used project, Input Tax Credit shall be available on pro-rata basis in proportion to carpet area of the commercial portion in the ongoing projects to the total carpet area of the project. On the commercial portion in the ongoing projects tax shall be payable at 12% along with the benefit of ITC even after 1st April, 2019.

Condition for Applicability of New GST Rates

Builders need to purchase 80% of inputs and input services from the registered persons. Input and input services do not include purchase of capital goods, JDA (Joint Development Agreements)/TDR (Transferable Development Rights), FSI, long-term lease (premiums). If there is a shortfall in meeting in the above condition of 80% purchase of input and input services from the registered persons than the builder shall be liable to pay tax at 18% on reverse charge mechanism (RCM) basis. However, builders need to pay tax on cement purchased from unregistered persons at 28% under RCM and on capital goods under RCM at applicable rates.